Tata Motors remains a key player in India’s automotive sector, with a diverse portfolio spanning commercial vehicles, passenger cars, electric vehicles (EVs), and luxury brands like Jaguar Land Rover (JLR). However, its stock has experienced volatility, dropping 3.57% to Rs 686.70 as of June 16, 2025, amid market challenges like tariff threats and declining sales. Investors are keen to understand the Tata Motors share price target 2025 and whether this stock offers a good opportunity in the coming years. In this article, we’ll analyze the current price, factors influencing its value, short- and long-term forecasts, and whether it’s a smart investment in Tata Motors stock forecast 2025. Let’s dive into the details and see if Tata Motors can drive your portfolio forward!

What Is Tata Motors’ Current Share Price?

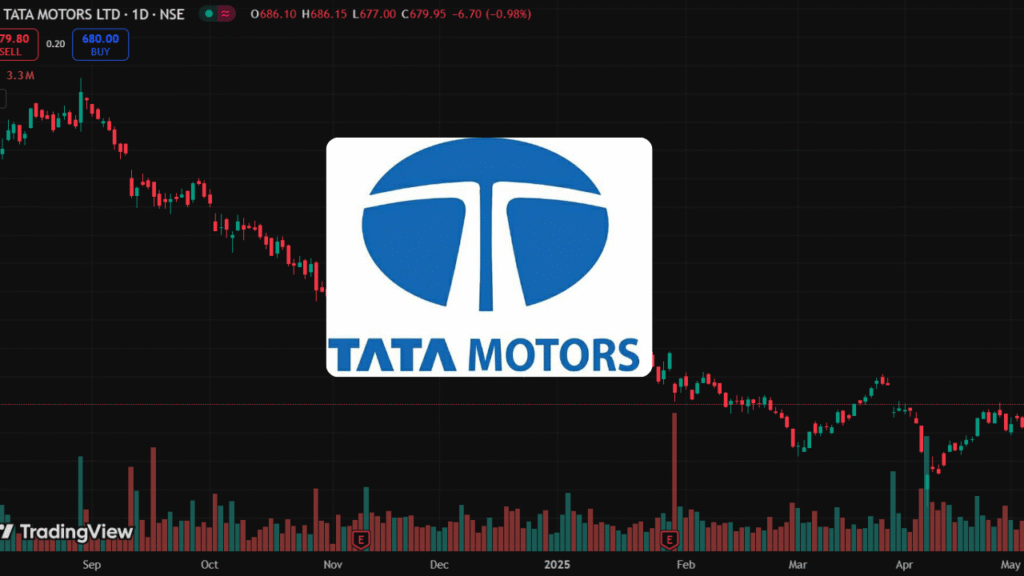

Tata Motors’ stock closed at Rs 686.70 on June 16, 2025, on the NSE/BSE, reflecting a 3.57% decline from its previous close of Rs 712.05. Over the past year, the stock has seen a significant drop of 30.47%, with a 52-week high of Rs 1,179 and a low of Rs 535.75. Despite this, the company’s market capitalization stands at Rs 2,62,138.52 crore, making it a large-cap stock in the auto sector. Financially, Tata Motors reported a net profit of Rs 27,830 crore for 2025, a slight decrease from Rs 31,106.95 crore in 2024, with revenues marginally up at Rs 439,695 crore. The company also declared a dividend of Rs 6 per share in May 2025, offering a yield of 0.84%. While these figures show resilience, the stock’s recent performance raises questions about its short-term potential.

Factors Influencing Tata Motors’ Share Price in 2025

Several factors will shape Tata Motors’ stock performance in 2025 and beyond:

- Electric Vehicle (EV) Growth: Tata Motors is a leader in India’s EV market, with models like the Nexon EV and Tigor EV. The company aims for a 20% market share in passenger vehicles by FY29, backed by a Rs 35,000 crore investment plan. However, sales challenges and competition in the EV space could impact growth.

- Jaguar Land Rover (JLR) Performance: JLR accounts for 71% of Tata Motors’ revenue (as of 9M FY25). While JLR achieved net debt zero and strong sales of models like the Defender, global trade challenges and tariff threats could affect profitability.

- Strategic Demerger: Tata Motors plans to split into two entities—one for commercial vehicles and another for passenger vehicles (including EVs)—with NCLT approval expected by Q2 FY2026. This could unlock value but introduces short-term uncertainty.

- Market and Macroeconomic Conditions: The Sensex crashed 800 points on June 12, 2025, with the Nifty below 24,900, driven by renewed tariff threats. Such market volatility, coupled with inflation and interest rates, impacts auto stocks like Tata Motors.

- Financial Health: Tata Motors reduced its debt-to-equity ratio to 0.54 in 2025 from 1.16 in 2024, a positive sign. However, a 4% decline in total sales for FY2024-25 (9,12,155 units vs. 9,49,015 in FY24) raises concerns about demand.

These factors create a mixed outlook—while strategic moves and EV focus are promising, external pressures could weigh on the stock in the near term.

Tata Motors Share Price Target for 2025

Analyst forecasts for the Tata Motors share price target 2025 vary widely, reflecting differing views on its growth potential:

- Motilal Oswal: A neutral rating with a target of Rs 690, citing margin pressures and weak demand as concerns.

- Figw.in: Predicts a range of Rs 698.10 to Rs 1,110.56, averaging Rs 848, a 49.96% increase from the current price. However, technical indicators suggest a bearish sentiment.

- Exla Resources: More optimistic, forecasting Rs 1,703 to Rs 1,926, driven by strong financial growth and reduced debt.

- Dollarrupee.in: Estimates a monthly average of Rs 741 for June 2025, with a year-end target of Rs 918 by December 2025.

- Trademint.in: Projects a maximum of Rs 1,300, a 45% increase, factoring in EV growth, the India-UK FTA, and the demerger.

- INDmoney: Suggests a target of Rs 800.48, a 12.42% upside, but highlights EV sales challenges.

The wide range (Rs 690 to Rs 1,926) reflects uncertainty. A realistic target, balancing optimism with current market trends, might fall between Rs 800 and Rs 1,000 by the end of 2025. This accounts for potential recovery in the auto sector, as noted by analysts expecting normalcy by mid-FY2026, but also considers near-term challenges like declining sales and market volatility.

Long-Term Forecast: 2026 to 2030

Looking beyond 2025, Tata Motors’ long-term outlook depends on its ability to navigate challenges and capitalize on growth opportunities:

- 2026: Analysts predict a range of Rs 920 to Rs 1,536 (Web:17), with an average of Rs 1,235.38 (Web:2). The demerger, if successful, could boost investor confidence, and EV adoption is expected to accelerate.

- 2027–2030: Forecasts vary significantly. Trademint.in projects Rs 2,095 by 2030, while Exla Resources estimates Rs 2,793 to Rs 3,016. More conservative estimates, like those from Figw.in, suggest Rs 1,372.84 by 2026, implying slower growth. JLR’s projected 6.5% CAGR in volumes (FY2025–2027) and Tata Motors’ focus on sustainability could drive long-term gains, but competition and global economic conditions remain risks.

The long-term trajectory looks promising, especially with the EV market’s growth and Tata Motors’ strategic restructuring. However, investors should monitor macroeconomic trends and the company’s ability to manage competition in the EV space.

Should You Invest in Tata Motors Stock?

Deciding whether to invest in Tata Motors in Tata Motors investment analysis 2025 depends on your risk tolerance and investment horizon:

- Pros:

- Strong EV leadership in India, with models like the Harrier EV launched at Rs 21.49 lakh.

- Reduced debt (debt-to-equity at 0.54) and a solid net profit of Rs 27,830 crore.

- Strategic initiatives like the demerger and India-UK FTA could unlock value.

- Attractive valuation: A P/E ratio of 9.29 (June 16, 2025) compared to the sector average of 21.67 suggests the stock is undervalued.

- Cons:

- Recent sales declines (4% drop in FY2024-25) and a 30.47% stock price drop over the past year signal short-term risks.

- Bearish technical indicators, with the stock trading below its 200-day moving average.

- Global challenges, including tariff threats and competition in the EV and luxury segments.

Tata Motors may be a good long-term investment for those bullish on the EV theme and willing to weather short-term volatility. However, near-term challenges suggest caution—consider waiting for a better entry point, such as after the demerger clarity in Q2 FY2026.

How to Analyze Tata Motors Stock for Investment

To make an informed decision, use these steps to analyze Tata Motors stock:

- Check Financial Metrics: Look at key ratios like P/E (9.29), P/B (0.42), and ROE (23.96% in 2025). Compare these with industry peers like Maruti Suzuki and Mahindra & Mahindra.

- Monitor Sales Trends: Track monthly sales data—passenger vehicle sales rose 3% in March 2025, but overall FY2024-25 sales dropped 4%. Improving trends could signal a recovery.

- Follow Analyst Ratings: Of 31 analysts, 13 recommend a buy, 9 suggest a hold, and 3 advise a sell (as of June 2025). Consensus leans toward cautious optimism.

- Assess Market Conditions: Keep an eye on macroeconomic factors like interest rates, inflation, and global trade policies, which heavily impact auto stocks.

- Technical Analysis: The stock is below its 50-day and 200-day moving averages, indicating a bearish trend. Watch for a breakout above key resistance levels (e.g., Rs 750) as a buying signal.

Combining fundamental and technical analysis will help you time your investment and manage risks effectively.

FAQs About Tata Motors Share Price Target

Analyst targets range from Rs 690 to Rs 1,926, with a realistic range of Rs 800 to Rs 1,000 by year-end, depending on market recovery and strategic execution.

It’s a potential long-term buy for EV-focused investors, but short-term risks like sales declines and market volatility suggest caution.

EV market growth, the demerger, JLR’s performance, and favorable trade policies like the India-UK FTA could boost the stock.

Tata Motors’ P/E ratio of 9.29 is lower than the sector average of 21.67, making it undervalued compared to peers like Maruti Suzuki and Mahindra & Mahindra.

Summary: Is Tata Motors Stock a Buy in 2025?

Tata Motors presents a mixed picture in Tata Motors stock forecast 2025. While its leadership in EVs, reduced debt, and strategic initiatives like the demerger are positives, recent sales declines and market volatility pose risks. The Tata Motors share price target 2025 could range from Rs 800 to Rs 1,000, with long-term potential to reach Rs 2,000 or more by 2030 if EV growth and global conditions align. For now, cautious investors might wait for a clearer market outlook, while long-term believers in the EV theme could find value at current levels. Stay informed with Tata Motors investment analysis 2025 updates on our site, and share your thoughts below!