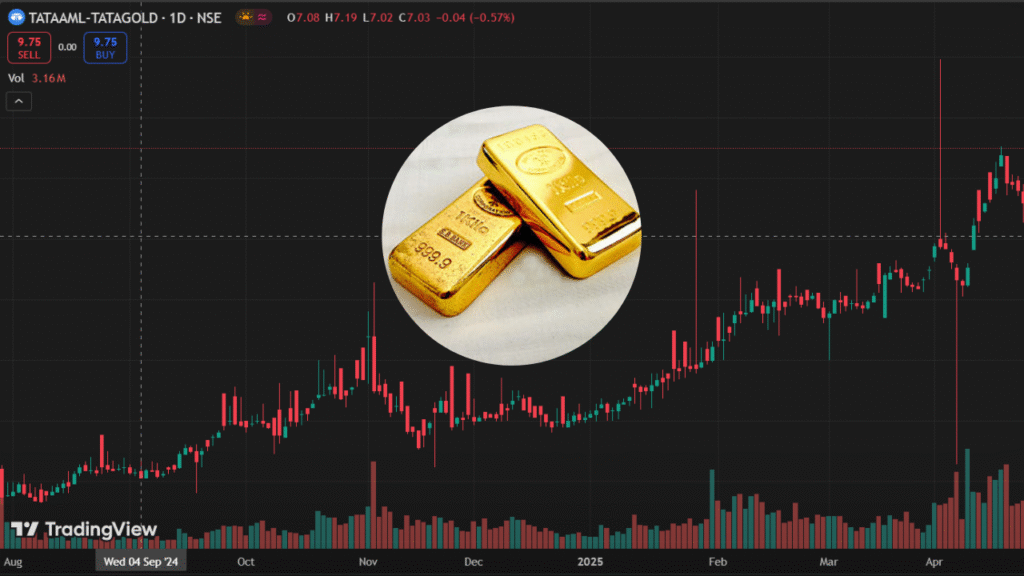

The TATA Gold Share Price Target 2030 is drawing attention from investors who want to tap into the stability and growth potential of gold through the Tata Gold Exchange Traded Fund (ETF). Managed by Tata Asset Management, this ETF tracks the domestic price of gold, offering a hassle-free way to invest in the yellow metal without worrying about storage or purity. With gold being a trusted safe-haven asset, its price is influenced by global factors like inflation, geopolitical tensions, and currency fluctuations. As of June 2025, the ETF’s share price is around ₹7,100 per unit, reflecting domestic gold prices. This article dives deep into the TATA Gold Share Price Target 2030, exploring gold price forecasts, ETF performance, investment benefits, and key factors to help you make smart investment choices.

Overview of TATA Gold Share Price Target 2030

The TATA Gold Share Price Target 2030 hinges on gold price forecasts, as the ETF mirrors domestic gold prices, subject to minor tracking errors. With gold at ~₹7,100 per gram in June 2025, analysts predict a rise to $4,626–$7,000 per ounce by 2030, translating to ₹38,400–₹58,100 per 10 grams in India (assuming 1 USD = 83 INR). The ETF’s NAV, tied to 1 gram per unit, could reach ₹3,840–₹5,810 per unit. The table below outlines key details for investors.

| Detail | Information |

|---|---|

| Fund Name | Tata Gold Exchange Traded Fund (TATAGOLD) |

| Current Price (June 2025) | ₹7,100 per unit (1 gram gold) |

| Market Cap | ₹657.62 Cr |

| 2030 Price Target | ₹3,840–₹5,810 per unit |

| AUM | ₹657.62 Cr (as of June 2025) |

| Expense Ratio | 0.36% |

| Investment Objective | Track domestic gold prices |

| Key Factors | Gold demand, inflation, currency rates |

Note: Gold prices fluctuate; check nseindia.com for updates.

TATA Gold ETF: Fund Overview

The Tata Gold ETF, launched by Tata Mutual Fund, is designed to deliver returns aligned with domestic gold prices, making it a go-to choice for investors seeking exposure to gold without physical ownership. Listed on the NSE with the ticker TATAGOLD, it invests 96.83% in gold and 3.17% in cash equivalents, ensuring minimal tracking error. As of June 2025, its NAV is ~₹7,100 per unit, reflecting the domestic gold price of ~₹7,100 per gram for 24-karat gold. With an annualized return of 13.36% since inception, it’s a reliable option for portfolio diversification. Visit tatamutualfund.com for details.

Gold Price Forecast for 2030

The TATA Gold Share Price Target 2030 depends on gold price trends, driven by global economic factors. Analysts predict gold prices will rise significantly by 2030 due to sustained demand and inflation:

- CoinPriceForecast: Gold could hit $7,378 by 2030, a 59% rise from $4,626 in 2026.

- LiteFinance: Suggests gold may reach $5,000–$7,000 per ounce by 2030, driven by central bank buying and geopolitical risks.

- InvestingHaven: Projects gold at $4,000–$5,000, with potential for higher peaks in a bullish market.

Converting to INR (1 USD = 83 INR, hypothetical), $4,626–$7,000 per ounce equals ₹38,400–₹58,100 per 10 grams, or ₹3,840–₹5,810 per gram. Since 1 ETF unit ≈ 1 gram, the share price target is ₹3,840–₹5,810.

Factors Driving TATA Gold Share Price

Several factors shape the TATA Gold Share Price Target 2030, making it a compelling investment:

- Inflation Hedge: Gold’s value rises with inflation, boosting ETF returns during economic uncertainty.

- Geopolitical Tensions: Conflicts and trade disputes, like US-China tariff wars, increase gold demand.

- Central Bank Buying: Global banks purchased 710 tonnes quarterly in 2025, supporting prices.

- Currency Fluctuations: A weaker INR or USD strengthens gold prices in India.

- Risks: Tracking errors, expense ratios (0.36%), and market volatility may affect returns.

Note: Monitor global economic trends and INR-USD rates for accurate predictions.

Why Invest in Tata Gold ETF?

The Tata Gold ETF is a smart choice for investors seeking stability and growth. Its benefits include:

- Liquidity: Traded on NSE, it offers easy buying/selling like stocks.

- No Storage Hassle: Eliminates costs and risks of physical gold storage.

- Diversification: Adds a safe-haven asset to balance equity-heavy portfolios.

- Low Costs: With a 0.36% expense ratio, it’s cost-effective compared to physical gold.

However, investors should watch for gold price volatility and currency risks. Experts suggest a 5–10% portfolio allocation to gold ETFs for balanced growth.

FAQs

Analysts predict ₹3,840–₹5,810 per unit, based on gold price forecasts of $4,626–$7,000 per ounce.

It offers liquidity, no storage costs, and tracks gold prices for diversification.

Inflation, geopolitical risks, and central bank demand boost gold prices.

Gold price volatility, tracking errors, and currency fluctuations may impact returns.

A weaker INR increases domestic gold prices, raising the ETF’s NAV.